Preventing Belly Fat During Menopause: A Guide to Healthy Eating, Exercise, and Stress Management

Women going through menopause need to be aware of the changes in their metabolism and focus on reducing starch intake, increasing protein and fiber consumption, getting enough sleep, and exercising…

Cuban Diplomat Speaks Out on U.S. Migration Policies, Geopolitical Conflicts and Domestic Challenges Affecting the Island Nation”.

During a recent interview, we had the opportunity to speak with Carlos Fernández de Cossío, Cuba’s deputy minister of foreign affairs, about the high-level U.S.-Cuban migration talks that took place…

Architecture Firms Facing Persistent Business Challenges Amid Inflation and Supply Chain Disruptions

Architecture firms are facing challenging business conditions, as evidenced by the AIA/Deltek Architecture Billings Index (ABI) score of 43.6 for March. This marks the 14th consecutive month of decreasing billings,…

How Nelly Korda Became the World’s Top Teacher with Her Elite Full-Swing Wedges: 2 Key Tips for Success

Nelly Korda’s impressive golf game includes many aspects worth noting. At 25 years old, she made history by becoming the third LPGA Tour player to win five tournaments in a…

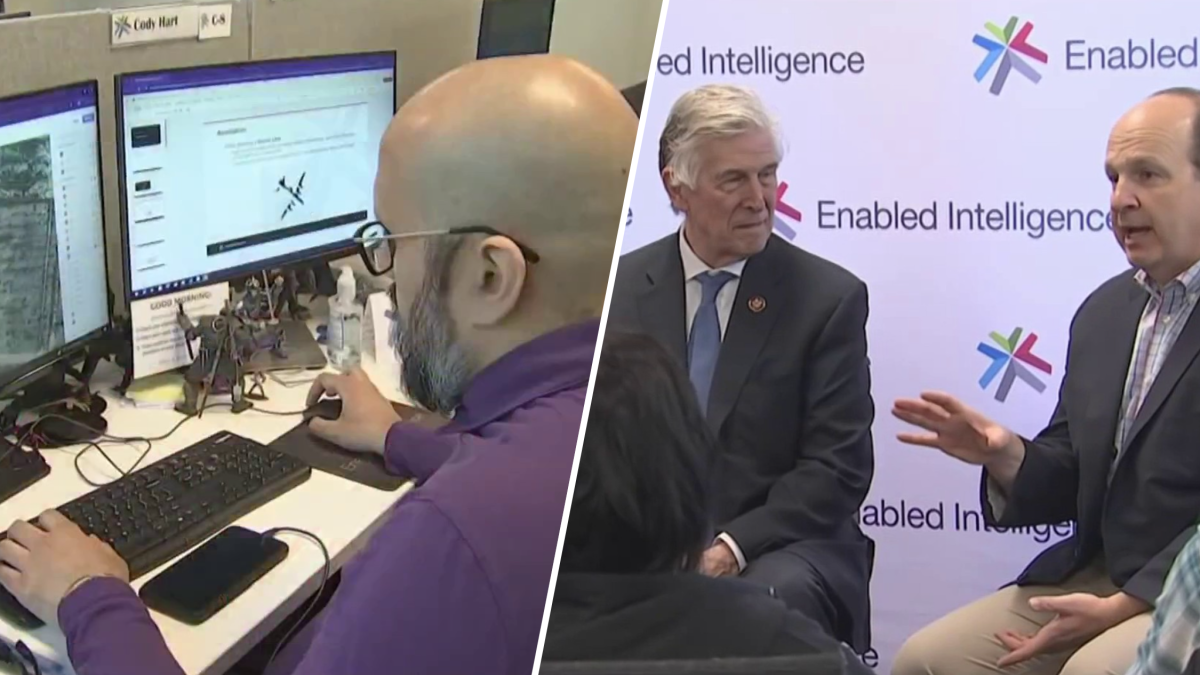

Neurodiverse individuals discover career opportunities in AI technology at a Northern Virginia company – NBC4 Washington报道

Data labeling or computer annotation may seem mundane, but for Cody Hart, who is neurodivergent, it adds value to his life. Hart expressed that working at Enabled Intelligence in Falls…

Three Arlington establishments recognized as top 250 sports bars in the U.S.

A recent ranking of the top 250 sports bars in the United States by betting site BetUS has identified three sports bars in Arlington, Virginia as being among the best…

Science With A Twist: Exploring the Personal Impact of Science on Local Residents through Storytelling at the Arizona Science Center.

The Arizona Science Center is hosting a special Science With A Twist event for guests 21 and over. This edition will feature a live show about how science has impacted…

FIT Together: A Six-Week Fitness Program Promoting Healthy Family Ties in Michigan City

A brand-new six-week fitness program, FIT-Together, is now open for registration at Franciscan Health Michigan City. This family-focused initiative aims to promote health and wellness among families with children aged…

The Rising Tide of Europe’s Economy Faces Challenges in Global Supply Chains: The Case of Iron and Steel Scrap

In recent years, Europe’s economy has shown signs of growth, as indicated by the recent strong Purchasing Managers’ Indices. The Eurozone saw a significant increase in April, with Germany’s service…

Biden Takes on Trump over Abortion Rights at Florida Campaign Event

At a campaign event in Florida, President Joe Biden criticized former President Donald Trump for his role in the overturning of abortion rights. Biden took a jab at Trump’s recent…