American Airlines Unveils Luxurious In-Flight Amenities for Summer Travelers.

American Airlines is launching its first rotating collection of premium amenities over Memorial Day Weekend, including a new front-row flagship suite, new bedding, and enhanced dining options. This move by…

An Illustrated Guide to Voting in the World’s Largest Democracy

India is gearing up to vote in the largest ever general election in the world, with nearly a billion people eligible to participate over a period of just over six…

Controversial Katy ISD Technology Policy Sparks Disagreement Among Parents Over Student Use of Personal Devices

A Katy Independent School District parent recently contacted ABC13 to express their outrage over a new technology policy being implemented in the district. The new program will prohibit students from…

J.K. Dobbins agrees to one-year deal with Chargers after leaving Ravens

Running back JK Dobbins has officially signed a one-year contract with the Los Angeles Chargers, as confirmed by his agency LAA Sports. This move comes after Dobbins spent four seasons…

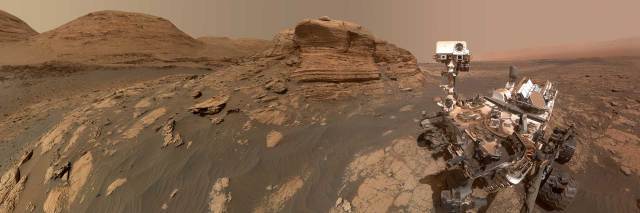

Curiosity’s Virtual Tour: Exploring the Red Planet and Unraveling its Past

Curiosity, a car-sized rover equipped with advanced technology, is exploring the Gale Crater on Mars. The rover’s 7-foot-long arm allows it to place tools near rocks for study, while its…

Nova Festival Survivor Suicide Claims Debunked by Ministry of Health: What You Need to Know

The Ministry of Health has denied Guy Ben Shimon’s claims that about 50 Nova Festival survivors had committed suicide. The Ministry stated that they do not have data on the…

Gold in Investment: A Safe Haven Amidst Uncertainty, But Is It the Right Way to Build Wealth?

The price of gold has been steadily increasing due to geopolitical tensions and fears of inflation. Many see gold as a safe haven for their investments during times of crisis,…

Tenniscore Takes Over Summer: Zendaya’s Challengers, Sportswear Brands Revive the Style, and TALA Launches New Health Club Collection

With the release of Zendaya’s upcoming film, Challengers, and tennis-inspired collections from sportswear brands like Lacoste and adidas, tenniscore is making a comeback this summer. Additionally, TALA, known for its…

Armenian and Saudi Arabian Foreign Ministers discuss regional matters

Armenian and Saudi Arabian Foreign Ministers Ararat Mirzoyan and Faisal bin Farhan Al Saud met today to exchange ideas on regional issues. Mirzoyan provided an update on the developments in…

Buncombe County Implementing AI Technology for Non-Emergency Call Responses

The Buncombe County Sheriff’s Office in Asheville, N.C. announced plans to transition non-emergency calls to a form of AI technology called “machine learning.” This change is intended to improve response…