Insulin Makers and Pharmacy Benefit Managers Face Allegations of Deceptive Pricing in Lawsuit by Health Benefits Fund

The International Union of Operating Engineers Local No. 478 Health Benefits Fund has recently filed a complaint in the US District Court for the District of Connecticut against major insulin…

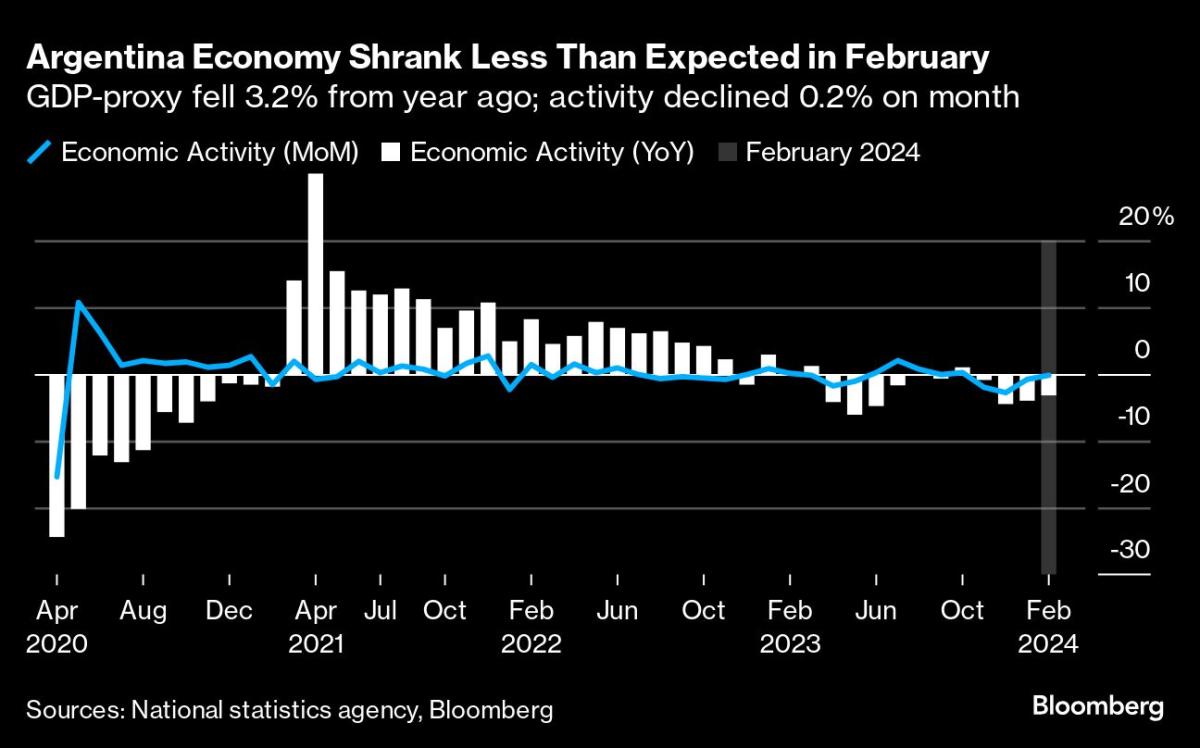

Economic Shock Therapy: President Milei’s Plan Brings Short-Term Success but Long-Term Concerns for Argentina”.

In February, Argentina’s economy saw a 0.2% monthly decline in economic activity, marking the fourth consecutive month of decline. Despite this, President Javier Milei’s economic shock therapy plan is starting…

Triple Victory for WKU Student Publications at College Media Business & Advertising Managers Awards

During an awards ceremony on April 19, three student leaders from WKU Student Publications were recognized by College Media Business & Advertising Managers. Emma Bayens, a senior photojournalism major from…

World Sales Secured for Director’s Fortnight Film ‘The Falling Sky’ by Rediance

Rediance, an international sales agent based in China, has acquired the world sales rights to the feature documentary film “The Falling Sky.” The film is set to premiere at the…

Cervantes Institute and Apple Music Partner to Discover the Greatest Spanish Lyrics of All Time

The Cervantes Institute and Apple Music have teamed up with a group of influential artists to search for the best Spanish song lyrics in history as part of a project…

Max Scherzer prepares for his first rehab outing following successful back surgery

39-year-old Texas Rangers right-hander Max Scherzer, a three-time Cy Young Award winner, is gearing up for a minor league rehab start on Wednesday following back surgery during the offseason. This…

Bridging the Gap: Tackling Global Challenges through Science and Inclusivity in Launching the UNESCO Call to Action

The UNESCO Call to Action: Closing the Gender Gap in Science, launched on the 2024 International Day of Women and Girls in Science, has brought attention to the urgent need…

Revolutionizing Healthcare: The Promise and Pitfalls of Integrating Artificial Intelligence

The healthcare industry has begun to incorporate artificial intelligence (AI) into its operations, leading to advancements and challenges. The focus of this fact sheet is on how AI can revolutionize…

Europe Bans Goods Made with Forced Labor: A Step Toward Eliminating Modern Slavery Globally

In Europe, a new rule has been approved to ban goods manufactured with forced labor from entering the single market. The regulation was passed with a large majority of 555…

Powering Up with Pizza: A Review of Cecconi’s West Hollywood

As a journalist, I recently had the opportunity to dine at Cecconi’s, a renowned “power lunch” spot in Los Angeles. The hostess shared an interesting tidbit with me, mentioning that…